The stock market has fumed a lot of excitement throughout the world, and finally, people in India have begun to see the possibilities it presents. On the one hand, people are anxious to join in the markets, whereas, on the other hand, the fact that 99 percent of individuals lose money terrifies them.

If we told you that you could make money without ever having to purchase or sell equities on the stock market, how would you react? Yes, you can accomplish this goal by using call options and put options. Let us explain more about it.

An option is a process under which people can speculate the price of a particular asset at a specific time. This means that the person does not need to buy or sell any stocks but simply predict the price of them during a specific time.

You can practice this by purchasing a contract of the price and the time of asset in the future. It is not under the obligation for the participant to buy or sell it at the contract’s end. They even have the option to let it get expired. Mostly, the options can be bought or sold in lots. One lot contains around 100 shares.

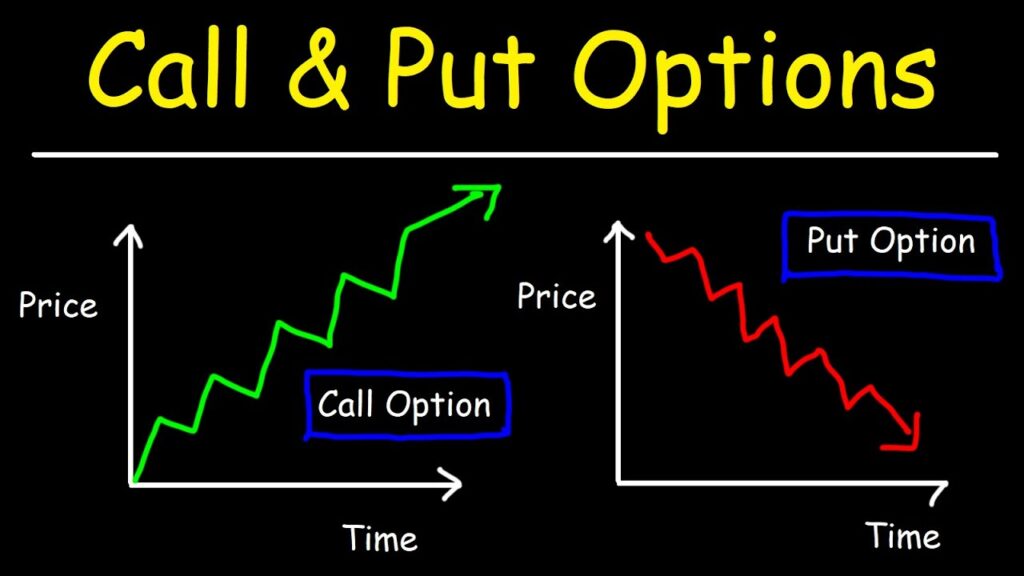

The buying and selling of options contain a fee that the person needs to pay regardless of the profit or the loss. Options are of two types– Call Options and Put options. Let’s understand them in detail.

A Call option simply gives an investor or a trader the right to purchase any stock at a specific price within a particular time period. The vital part to note here is the fact that the person buying the stock is not under any obligation to buy the stock. If in case, the price of the stock does not reach the prediction of the investor, then he can let the option expire without buying any of it. Let us understand this through an example.

Assume A’s stock is selling for INR 90 in January. You believe that share prices will rise during the next few months. In such a situation, you can purchase a six-month call option to acquire 100 shares of A for INR 100 by July 31st. This call option costs about INR 200, i.e. (100 shares x INR 2 per share), assuming that the cost to purchase the call option is INR 2 per share. Keep in mind that when it comes to options, each lot is for 100 shares.

Situation 1: On June 15th, if shares of A are trading at INR 110, you can execute your call option and profit INR 800 (INR 10 profit x 100 shares – 200 original investment).

Situation 2: If the values of share A do not rise as expected and do not reach INR 100 within the six-month option period, you can let the option expire and preserve your money. The only loss you would incur is the original investment of INR 200.

A Put option is just the exact opposite of what a call option can do. Anyone with the right to participate in the stock market can simply sell a stock for a speculative price at a particular time period. This means that he can predict the price to fall in the future and then buy it at a cheaper rate to make profits. Let us see an example to understand.

Assume you hold some shares of B that you bought for INR 50 each. The stock is now trading at INR 70 per share as of January. You want to shield yourself from potential stock price decreases and reduce your risk. In this situation, you might purchase a six-month put option with a strike price of INR 70 that must be exercised by July 31st.

Situation 1: Assume the price of stock B falls, and it is trading at INR 60 per share on June 15th. Even if the shares are presently trading at a lower price, you may exercise your put option and sell them for INR 70.

Situation 2: If the price of B continues to rise and exceeds INR 70 per share, you can let your put option expire and still profit from the increasing value of your own shares, which you initially purchased for INR 50.

Thus, call and put options are a terrific method to benefit more without putting too much money at risk upfront.

SMT offers exemplary services in the Stock Markets. Our team comprises some of the most experienced and qualified stock market analysts. Our services include Portfolio Management and Trading on Equity. Get in touch now to start your stock market journey and create wealth for yourself.